Finance

The Hidden Reality: Effective Tax Rates and Their Impact

When it comes to taxation in the United States, the subject can quickly become a labyrinth of complex rules, deductions, and calculations. At the heart of this intricate system lies the concept of effective tax rates, which often differ significantly from the statutory tax rates. Understanding effective tax rates is crucial for individuals, businesses, and policymakers alike, as it provides a more accurate representation of the actual tax burden shouldered by taxpayers.

What Are Effective Tax Rates?

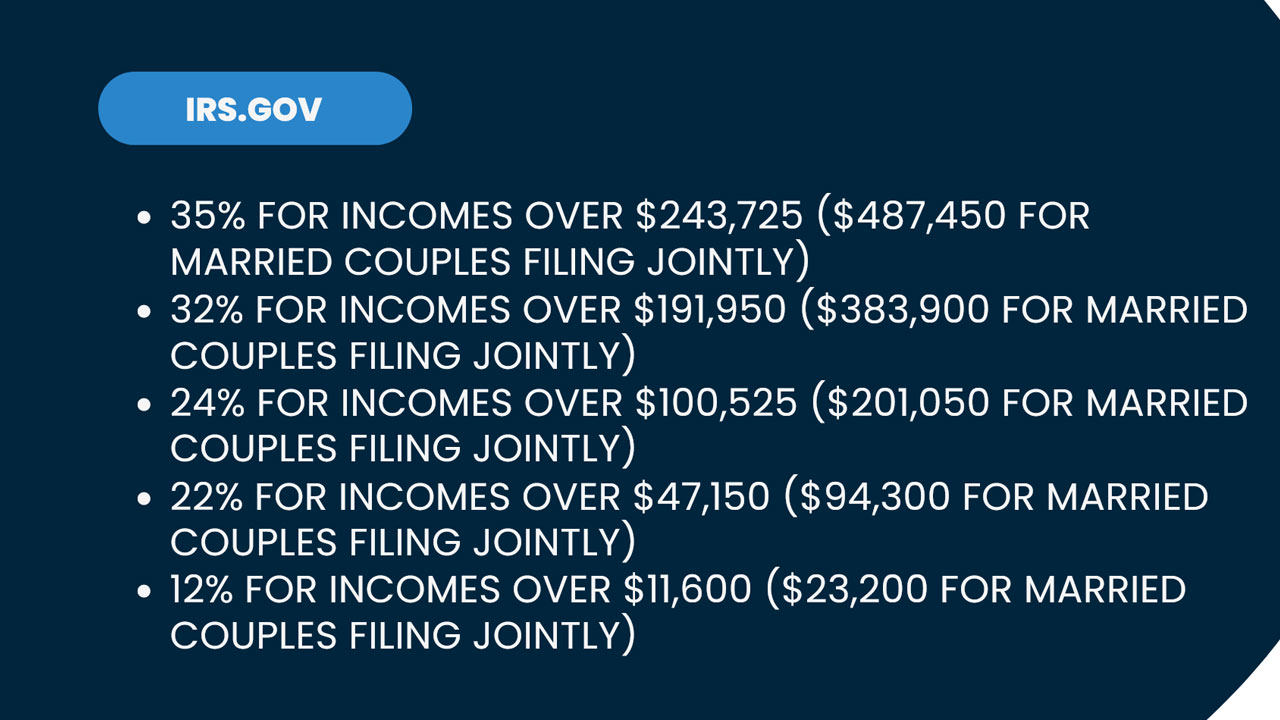

Effective tax rates refer to the actual percentage of income paid in taxes after accounting for various deductions, credits, and exemptions. In contrast, statutory tax rates are the legally mandated tax rates imposed on different income levels or categories of taxpayers. The discrepancy between effective and statutory rates arises due to the complexities of the tax code, which includes a myriad of provisions designed to incentivize or discourage certain behaviors.

1. The Importance of Effective Tax Rates

Effective tax rates play a pivotal role in analyzing the true impact of tax policies on different segments of the population. By examining effective rates, we can better understand the distribution of the tax burden across income levels, industries, and geographic regions. This information is invaluable for policymakers seeking to craft equitable and efficient tax policies that promote economic growth while addressing social and economic disparities.

Moreover, effective tax rates are crucial for businesses and individuals when making informed financial decisions. For businesses, understanding their effective tax rate can influence investment decisions, location choices, and overall profitability. Individuals, too, can benefit from analyzing their effective tax rates, as it may reveal opportunities for tax optimization and informed financial planning.

2. Factors Influencing Effective Tax Rates

Several factors contribute to the variation between statutory and effective tax rates in the United States. These include:

- Deductions and Exemptions: The tax code allows for numerous deductions and exemptions that reduce taxable income, thereby lowering the effective tax rate. Common examples include mortgage interest deductions, charitable contributions, and personal exemptions.

- Tax Credits: Tax credits directly reduce the amount of tax owed, rather than just lowering taxable income. Examples include the Earned Income Tax Credit (EITC), Child Tax Credit, and credits for educational expenses or energy-efficient home improvements.

- Capital Gains and Dividends: Income from investments, such as capital gains and dividends, is often taxed at preferential rates lower than ordinary income tax rates.

- Business Tax Provisions: Businesses can benefit from various tax provisions, including accelerated depreciation, research and development (R&D) credits, and tax breaks for certain industries or business activities.

- International Taxation: For multinational corporations, the interplay between domestic and international tax systems can significantly impact their effective tax rates, as they navigate complex rules surrounding foreign income, transfer pricing, and tax havens.

3. Analyzing Effective Tax Rates Across Income Levels

One of the most revealing aspects of effective tax rates is how they vary across different income levels. Studies by the Congressional Budget Office (CBO) and the Tax Policy Center have consistently shown that effective tax rates tend to be progressive, meaning higher-income households pay a larger share of their income in taxes compared to lower-income households.

However, the degree of progressivity and the distribution of the tax burden can fluctuate based on changes in tax policies and economic conditions. For example, the Tax Cuts and Jobs Act of 2017 (TCJA) brought significant changes to individual and corporate tax rates, deductions, and credits, altering the effective tax landscape for many taxpayers.

4. Understanding Effective Corporate Tax Rates

Effective corporate tax rates are a subject of ongoing debate and scrutiny. While the statutory federal corporate tax rate in the United States is 21% (reduced from 35% under the TCJA), the effective tax rate paid by corporations can vary substantially due to various tax provisions, deductions, and international tax strategies.

Critics argue that many large corporations exploit loopholes and engage in aggressive tax planning strategies to minimize their tax liabilities, resulting in effective tax rates well below the statutory rate. Proponents, on the other hand, argue that these tax provisions are necessary to maintain competitiveness and promote investment and job creation.

5. Moving Forward: Simplification and Transparency

As the debate around tax policy and fairness continues, there is a growing call for simplification and transparency in the tax system. Simplifying the tax code and reducing the number of deductions and credits could potentially narrow the gap between statutory and effective tax rates, making the system more straightforward and equitable.

Furthermore, increased transparency regarding effective tax rates could foster more informed public discourse and decision-making. By providing clear and accessible data on the actual tax burdens borne by different groups, policymakers, and the public can better evaluate the fairness and efficacy of tax policies.

In conclusion, effective tax rates offer a complex yet crucial lens through which to examine the intricacies of the U.S. tax system. Understanding the factors that shape these rates and their impact on different taxpayers is essential for crafting sound tax policies, promoting economic growth, and ensuring a fair distribution of the tax burden. As the nation grapples with fiscal challenges and debates over tax reform, embracing transparency and striving for a simpler, more equitable tax system should remain a priority.

Finance

Top Passive Income Ideas to Boost Your Earnings in 2024

In today’s fast-paced world, many people are seeking ways to generate passive income to achieve financial stability and freedom. Passive income is money earned with minimal active effort, allowing you to focus on other aspects of life while your investments or projects generate revenue. As we move into 2024, several passive income ideas have proven to be effective and sustainable. This blog will explore some of the best passive income ideas for 2024.

Maximize Your Earnings with These Passive Income Ideas in 2024

1. Real Estate Investments

Real estate has long been a favorite for passive income seekers. The potential for property appreciation and rental income makes it an attractive option.

- Rental Properties: Purchasing rental properties can provide a steady stream of income. With proper management, rental income can cover mortgage payments and expenses, leaving you with profit. Consider hiring a property management company to handle day-to-day operations.

- Real Estate Investment Trusts (REITs): REITs allow you to invest in real estate without owning physical properties. These companies own or finance income-producing real estate and distribute earnings to shareholders as dividends.

- Vacation Rentals: Platforms like Airbnb and VRBO enable you to rent out your property to travelers. This can be particularly profitable if you own property in a popular tourist destination.

2. Dividend Stocks

Investing in dividend-paying stocks is a reliable way to generate passive income. Companies that pay dividends typically distribute a portion of their profits to shareholders regularly.

- Blue-Chip Stocks: Invest in established companies with a history of paying regular dividends. These stocks are generally less volatile and provide a stable income.

- Dividend Growth Stocks: Look for companies that consistently increase their dividend payouts. This can lead to growing income over time.

- Dividend ETFs: Exchange-traded funds (ETFs) that focus on dividend-paying stocks can provide diversification and reduce risk.

3. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers with investors willing to fund their loans. As an investor, you earn interest on the loans you fund.

- Lending Platforms: Popular platforms like LendingClub and Prosper offer opportunities to invest in personal loans. You can choose loans based on risk and return profiles.

- Diversification: Spread your investments across multiple loans to mitigate risk. Even if some borrowers default, your overall portfolio can still be profitable.

4. Create and Sell Digital Products

Digital products require an upfront investment of time and effort but can generate income long after they are created.

- E-books and Online Courses: If you have expertise in a particular field, consider writing an e-book or creating an online course. Platforms like Amazon Kindle Direct Publishing and Udemy make it easy to reach a wide audience.

- Stock Photography and Art: If you are a photographer or artist, sell your work on platforms like Shutterstock, Adobe Stock, or Etsy. Each sale provides passive income.

- Software and Apps: Develop software or mobile apps that fulfill a specific need. Once published, these products can generate income through sales, subscriptions, or ads.

5. Affiliate Marketing

Affiliate marketing involves promoting other companies’ products and earning a commission on sales generated through your referral links.

- Content Creation: Build a blog, YouTube channel, or social media presence focused on a niche you are passionate about. Incorporate affiliate links in your content.

- Join Affiliate Programs: Sign up for affiliate programs offered by companies like Amazon, ClickBank, and ShareASale. These programs provide access to a wide range of products to promote.

- SEO and Traffic: Optimize your content for search engines to attract organic traffic. The more visitors you have, the higher the potential for earning commissions.

6. Create a YouTube Channel

YouTube offers monetization options that can turn your channel into a source of passive income. With over two billion monthly active users, YouTube provides a vast audience for content creators to tap into.

- Ad Revenue: Once your channel meets the eligibility criteria (1,000 subscribers and 4,000 watch hours in the past 12 months), you can join the YouTube Partner Program and earn money from ads displayed on your videos. Google AdSense will place ads on your videos, and you’ll earn a share of the revenue generated from viewers watching these ads.

- Sponsorships: As your channel grows, you can attract sponsorship deals from brands looking to reach your audience. Brands often pay influencers to create sponsored content that promotes their products or services. This can be a lucrative source of income, especially if you have a highly engaged audience.

- Memberships and Super Chats: Enable channel memberships to offer exclusive content and perks to your subscribers for a monthly fee. During live streams, viewers can purchase Super Chats, which highlight their messages and provide additional revenue. These features encourage viewer engagement and provide a steady stream of income from your most dedicated fans.

- Merchandise Sales: Utilize YouTube’s merchandise shelf to sell branded products directly to your audience. By creating and promoting your own merchandise, such as T-shirts, mugs, or other branded items, you can generate additional income while strengthening your brand’s identity.

- Affiliate Marketing: Incorporate affiliate marketing into your videos by promoting products or services that you use and trust. Include affiliate links in your video descriptions, and earn commissions on sales generated through those links. This can be particularly effective if your channel focuses on product reviews, tutorials, or niche topics.

By leveraging these monetization strategies, a YouTube channel can become a substantial source of passive income. Creating quality content that resonates with viewers and consistently growing your audience is key to maximizing your earning potential on the platform.

Conclusion

In 2024, generating passive income is more accessible than ever, thanks to diverse opportunities across various fields. From real estate investments and dividend stocks to digital products and affiliate marketing, each method offers unique benefits and potential for financial growth. By strategically investing your time and resources, you can create multiple income streams that require minimal ongoing effort. This not only helps to achieve financial stability but also provides the freedom to focus on personal passions and long-term goals.

Choosing the right passive income strategy depends on your interests, risk tolerance, and financial situation. It’s crucial to diversify your investments to mitigate risks and maximize returns. With careful planning and consistent effort, you can build a robust portfolio of passive income sources that support your financial aspirations and provide a steady stream of revenue. As you embark on this journey, remember that patience and persistence are key to achieving lasting financial independence and security.

Finance

Five Steps to Make More Money While Growing Your Career

In today’s fast-paced world, balancing career growth with financial advancement is a common goal. Many professionals strive to increase their earnings while climbing the career ladder. The good news is that it’s possible to achieve both simultaneously with the right strategies. This article will outline five practical steps to help you make more money while advancing in your career.

Achieving career growth and financial success requires a combination of strategic planning, continuous learning, and effective networking. By focusing on these areas, you can set yourself up for long-term success and financial stability. Let’s delve into the steps that can help you reach your career and income goals.

Balancing Act: How to Grow Your Career and Increase Your Income

1. Invest in Continuous Learning and Skill Development

Continuous learning and skill development are crucial in today’s dynamic job market. The more skills and knowledge you acquire, the more valuable you become to your current and potential employers.

- Take Courses and Certifications: Enroll in courses that are relevant to your field. Many online platforms offer affordable or even free courses that can help you stay updated with the latest trends and technologies.

- Attend Workshops and Seminars: Participate in industry-related workshops and seminars to gain new insights and network with professionals.

- Learn New Technologies: Stay abreast of the latest technological advancements in your industry. Learning new software, tools, or programming languages can make you more versatile and indispensable.

- Pursue Advanced Degrees: If feasible, consider pursuing an advanced degree that can open up higher-paying positions and opportunities for promotion.

2. Build a Strong Professional Network

Networking is a powerful tool for career growth and financial gain. The connections you make can lead to new job opportunities, partnerships, and valuable advice.

- Attend Industry Events: Regularly attend industry conferences, trade shows, and meetups to meet new people and stay informed about industry trends.

- Join Professional Associations: Become a member of professional organizations related to your field. These associations often provide resources, job listings, and networking events.

- Leverage Social Media: Use platforms like LinkedIn to connect with industry leaders, colleagues, and potential employers. Share your achievements and insights to build your professional brand.

- Seek Mentorship: Find a mentor who can provide guidance, support, and valuable industry connections. A mentor can help you navigate your career path more effectively.

3. Seek Opportunities for Advancement

Proactively seeking advancement opportunities within your organization can lead to higher earnings and career growth.

- Express Your Ambitions: Communicate your career goals to your supervisors. Let them know you are interested in taking on more responsibilities or moving up in the company.

- Volunteer for Challenging Projects: Take on challenging assignments that can showcase your skills and dedication. Successfully completing high-profile projects can make you a candidate for promotions.

- Request Regular Feedback: Ask for regular performance reviews and constructive feedback. Use this feedback to improve your performance and demonstrate your commitment to growth.

- Negotiate Your Salary: Don’t be afraid to negotiate your salary. Research industry standards for your position and confidently present your case for a raise.

4. Diversify Your Income Streams

Relying on a single source of income can be risky. Diversifying your income streams can provide financial security and increase your overall earnings.

- Freelancing: Offer your skills and services on a freelance basis. Platforms like Upwork and Fiverr can help you find clients looking for your expertise.

- Side Business: Start a side business that leverages your skills or interests. This could be anything from consulting to selling handmade products online.

- Investing: Invest in stocks, real estate, or other assets that can generate passive income. Make informed decisions to minimize risk and maximize returns.

- Teaching and Tutoring: Share your knowledge by teaching or tutoring others. This can be done in person or online and can provide a steady additional income.

5. Maintain a Strong Work-Life Balance

Maintaining a healthy work-life balance is essential for long-term career success and personal well-being.

- Set Boundaries: Establish clear boundaries between work and personal life. Avoid overworking and ensure you have time for rest and recreation.

- Take Care of Your Health: Prioritize your physical and mental health. A healthy lifestyle can improve your productivity and overall job performance.

- Plan Your Time Effectively: Use time management techniques to make the most of your work hours and free time. Tools like calendars and to-do lists can help you stay organized.

- Recharge Regularly: Take regular breaks and vacations to recharge. Time away from work can boost creativity and prevent burnout.

Conclusion

Making more money while growing your career is an achievable goal with the right approach. By investing in continuous learning, building a strong professional network, seeking advancement opportunities, diversifying your income streams, and maintaining a healthy work-life balance, you can enhance both your career and financial prospects. Remember, career growth and financial success are not mutually exclusive; they can complement each other when approached strategically. Start implementing these steps today, and you’ll be on your way to a more prosperous and fulfilling career.

Finance

When is the Best Time to Take Out a Car Loan?

For many Americans, owning a car is a necessity for getting to work, running errands, and maintaining the lifestyle they desire. However, the costs associated with buying a vehicle can be substantial, often requiring financing through an auto loan. If you’re considering taking out a car loan, it’s important to understand the factors that can impact the best timing and overall financial implications of your decision.

Car Loan Secrets: Maximizing Your Savings and Minimizing Costs

1. Saving for Your Dream Car

Before even thinking about a car loan, it’s wise to start saving for your dream car as early as possible. Set a realistic budget and stick to it diligently. Automating transfers from your checking account to a dedicated savings account can make the process seamless. Consider cutting back on non-essential expenses, such as dining out or streaming services, to boost your savings.

Additionally, explore high-yield savings accounts or money market accounts to maximize the growth of your savings through compound interest. Every little bit counts, and the more you can contribute upfront, the less you’ll need to finance.

2. The Consequences of Car Loans on Personal Finances

While car loans can make vehicles more accessible, they also come with significant financial implications. Interest charges can add thousands of dollars to the overall cost of your purchase, especially if you have a subprime credit score or opt for a longer loan term.

Furthermore, a car loan represents a long-term financial commitment that can impact your ability to save for other goals, such as retirement or a down payment on a home. It’s crucial to carefully consider the monthly payment and ensure it aligns with your overall budget and financial objectives.

3. Strategically Planning for a Car Loan

If you’ve decided that a car loan is necessary, there are several strategies you can employ to minimize the financial burden and secure the best terms possible.

- Improve Your Credit Score: Lenders heavily rely on your credit score to determine interest rates and loan terms. A higher credit score can lead to more favorable rates and potentially save you thousands of dollars over the life of the loan.

- Shop Around for the Best Rates: Don’t settle for the first loan offer you receive. Compare rates from various lenders, including banks, credit unions, and online lenders. Even a small difference in interest rates can have a significant impact on your total costs.

- Consider the Loan Term: While longer loan terms may seem appealing due to lower monthly payments, they often result in higher overall interest costs. Aim for the shortest loan term you can comfortably afford to minimize interest charges.

- Time Your Purchase Wisely: Certain times of the year may be better for securing deals on new or used cars. For instance, the end of the year or model year can be an opportune time to negotiate better prices as dealerships aim to clear out inventory.

- Negotiate Effectively: Don’t be afraid to negotiate the purchase price, interest rate, and fees associated with the loan. Conduct thorough research, compare offers, and be prepared to walk away if the deal isn’t favorable.

4. The Ideal Down Payment

When it comes to car loans, a larger down payment can work in your favor. A general rule of thumb is to put down at least 20% of the vehicle’s purchase price. This not only reduces the amount you need to finance but also demonstrates to lenders that you’re a responsible borrower, potentially qualifying you for better interest rates.

However, if a 20% down payment is out of reach, aim for the highest amount you can comfortably afford. Even a smaller down payment can lower your monthly payments and overall interest costs.

5. The Best Time to Take Out a Car Loan

While there’s no definitive “best” time to take out a car loan, certain periods may be more advantageous than others.

- When Interest Rates are Low: Monitor market trends and aim to secure a loan when interest rates are relatively low. This can significantly reduce the overall cost of financing your vehicle.

- During Promotional Periods: Automakers and lenders often offer promotional incentives, such as low-interest rates or cash-back offers, during specific times of the year. These promotions can make financing more affordable.

- When Your Financial Situation is Stable: Ideally, you’ll want to take out a car loan when your employment and income are steady, and you have a solid credit history. This increases your chances of securing favorable terms and rates.

- When You’re Prepared for the Long-Term Commitment: A car loan is a significant financial obligation, so it’s crucial to ensure you’re ready for the long-term commitment before signing on the dotted line.

Remember, while timing can be important, it’s equally crucial to assess your overall financial situation, budget, and long-term goals before taking on a car loan. Carefully weigh the pros and cons and ensure that the vehicle you’re financing aligns with your needs and financial capabilities.

In conclusion, owning a car is a dream for many Americans, but it’s essential to approach the financing process with careful planning and strategic decision-making. By saving diligently, improving your credit score, shopping around for the best rates, and considering the ideal down payment and loan term, you can increase your chances of securing a favorable car loan that aligns with your financial goals. Ultimately, the key is striking a balance between your desires and your ability to manage the long-term financial commitment responsibly.

-

News9 months ago

News9 months ago6 Ways To Attract a Rich Girl of Your Dream

-

Finance8 months ago

Finance8 months agoWhich credit card is best for small businesses?

-

Finance8 months ago

Finance8 months agoBest Business Credit Cards With 0% APR – February 2024

-

Finance8 months ago

Finance8 months agoHow To Apply For A Chase Business Credit Card

-

Finance10 months ago

Finance10 months agoLowe’s Credit Card: New Discounts on Lowe’s Purchases

-

Finance8 months ago

Finance8 months agoLimited Time: Sign up for Chase Freedom Unlimited for a Year of Unlimited Cash Back!

-

Entertainment10 months ago

Entertainment10 months agoNetflix Schedule January 2024

-

Tech10 months ago

Tech10 months agoApple Vision Pro: $3,499 headset finally has a release date